All Categories

Featured

Table of Contents

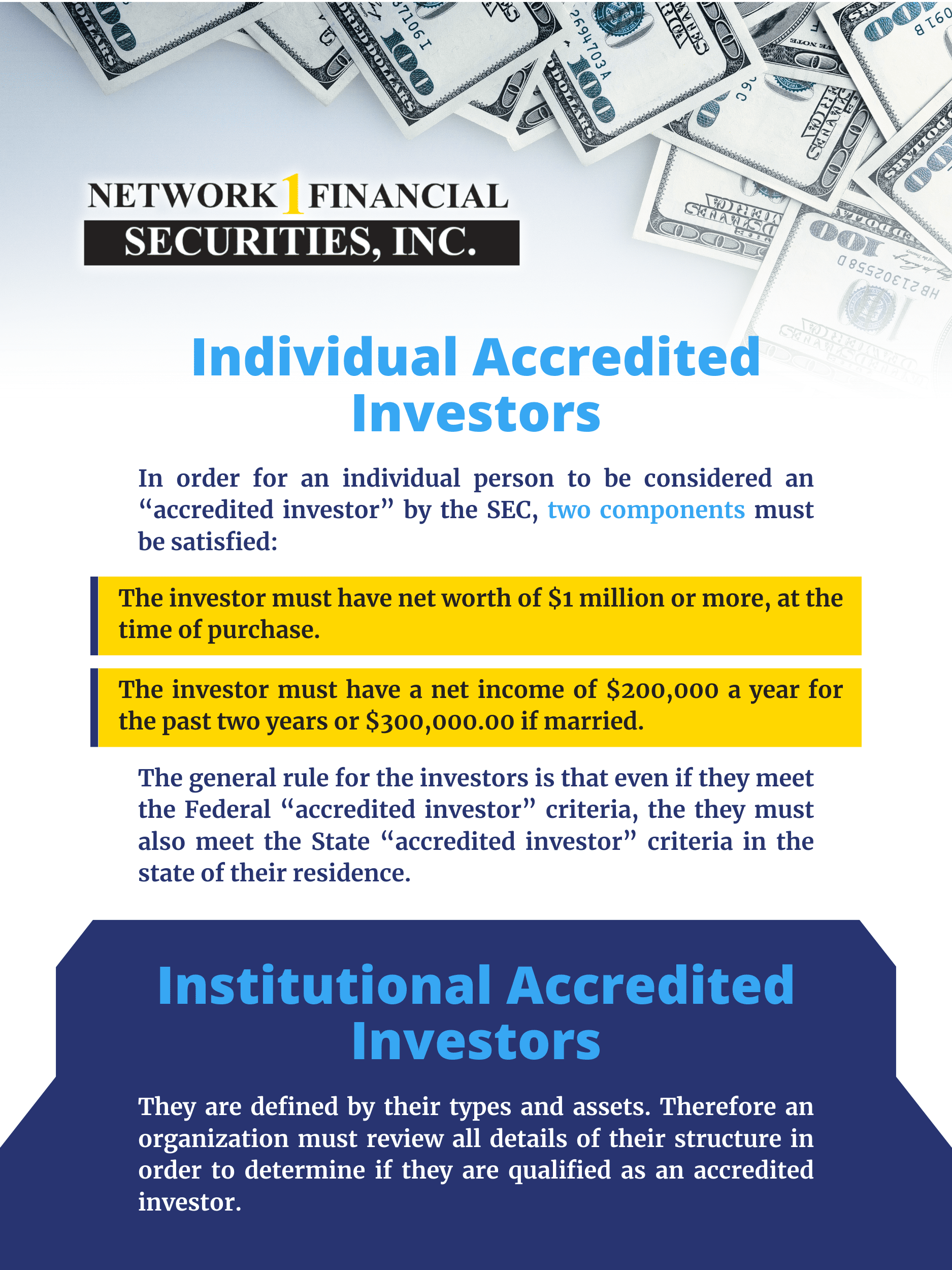

A recognized financier is a private or entity that has a particular degree of financial refinement. The idea is that if financial investment opportunities limit participation to capitalists who can pay for to take more threat and are able to carry out due persistance on financial investment chances, there is less of a need to sign up with companies created to secure specific financiers, particularly the SEC.For people, there are 3 major ways to certify as an accredited investor: By revenue: An individual investor can be considered an approved capitalist if they have yearly income of a minimum of $200,000 for the past 2 successive years and a sensible expectation of reaching this revenue degree in the existing year.

By properties: People can be thought about accredited capitalists if they have a total assets (possessions minus financial debts) of a minimum of $1 million, not including their main home. The $1 million threshold uses to both people and couples. become an accredited investor. By credential: People that hold a Collection 7, Series 65, or Collection 82 permit are accredited investors

A retired individual with $2 million in assets and very little income would certainly certify. So if an individual had annual income of $220,000 in 2021, $250,000 in 2022, and gets on track to gain $275,000 in 2023, but only had a web worth of $200,000, they would certainly qualify as an approved investor just by revenue.

Supervisors, exec officers, or basic partners of the business marketing the securities are also thought about certified investors, no matter their income or properties. And there are a number of ways that organizations or other entities can certify as recognized investors. Corporations with even more than $5 million in assets will certainly certify.

For instance, several early-stage startups restrict financial investments to accredited financiers, and there are many opportunities in industrial property available solely to approved financiers. The typical motif is that these kinds of investments have significant incentive possibility. Envision if you had actually taken part in an early financial investment round for (0.9%) or (3.69%).

Falsely Claim Accredited Investor

The idea is that the SEC wishes to protect financiers that can't afford to handle risks and take in losses, or that do not have the economic refinement to totally recognize the risks entailed with financial investment chances. This is why financial investments that anyone can put their money in (such as publicly traded stocks) are very closely viewed by the SEC.

This process depends upon the issuer of the protections or financial investment opportunities. Some might validate your accreditation condition themselves, such as by requesting income tax return or property statements. Some might just ask you to self-certify, while others could utilize a third-party verification service, such as the particular procedure, a lot of firms that supply unregistered financial investment chances take significant steps to make sure that only accredited investors get involved.

The most significant instance of chances offered to accredited financiers is private equity investments, such as endeavor resources bargains or direct investments in early-stage companies. You may have listened to of investors "obtaining in early" on firms such as Red stripe, SpaceX, or others that are still exclusive. accredited investor checklist. Well, recognized capitalists might have the ability to take part in venture financing rounds led by VC companies.

The has positions in and advises Meta Operatings systems and Tesla. The Motley Fool has a disclosure plan.

Is it your initial time looking for details on how to come to be a recognized capitalist in the U.S., however not sure where to start? The reliable day of the brand-new rules was December 8, 2020.

Regulatory authorities have stringent standards on that can be considered a certified investor. Under new regulations, individuals can now qualify as an approved financier "based upon steps of specialist expertise, experience or accreditations in enhancement to the existing examinations for earnings or total assets." To be considered a certified capitalist, people will need to give substantial proof that individual total assets goes beyond the $1 million threshold.

Institutional Accredited Investors

The function of governmental bodies like the SEC's policies for capitalist accreditation is to offer security to investors. The accreditation need looks for to guarantee that investors have adequate knowledge to understand the threats of the prospective financial investment or the financial resources to protect against the threat of financial loss.

There should additionally be a practical expectation that they will make the very same or extra in the current calendar year and the coming year. The 2nd means an individual can end up being a recognized investor is to have a web well worth going beyond $1M. This leaves out the value of their main house.

Once more, this is done either using income or via internet worth financial statements. A specific with each other with their spouse or spousal equivalent will be regarded recognized investors if they have a pre-tax joint revenue of a minimum of $300,000 for the 2 previous years. qualified purchaser status. They need to additionally get on track to make the exact same amount (or more) in the forthcoming year

Furthermore, the SEC has actually given itself the flexibility to reevaluate or include certifications, classifications, or credentials in the future. The last of the main manner ins which an individual can be regarded a certified capitalist is to be a knowledgeable staff member of a private fund. Experienced employees are defined as: An executive policeman, supervisor, trustee, basic partner, board of advisers member, or person offering in a comparable ability, of the private fund or an affiliated administration individual.

The adhering to can also qualify as certified investors: Monetary organizations. A corporation or LLC, not formed for the details function of getting the securities used, with overall assets in excess of $5M. Well-informed workers of exclusive funds. Particular sorts of insurer. For a thorough failure of the various types of accredited financiers, please see the definitions and terms used in Guideline D.

In the 1930s, federal legislators were seeking a method to secure investors while additionally stimulating new business growth. The Securities Act of 1933 was established to regulate offers and sales of protections in the United States - accredited investor standard. The idea was to do so by calling for companies to register a declaration with a selection of info

Who Can Be An Investor

The registration required to be considered efficient prior to it could be supplied to capitalists. However, regulatory authorities needed to guarantee that only seasoned investors with enough sources were taking part for safety and securities that were not signed up. These possibilities do not drop under federal or state safeties legislations. Because of this, Regulation D of the Securities Act of 1933 was established and the term approved capitalist was birthed.

Only investors who qualified therefore would certainly be able to take part in personal safety and securities and private investment offerings. By doing so, they desired to strike an equilibrium that would certainly boost business growth and additionally secure less experienced professional investors from riskier investments. difference between accredited and non accredited investor. As these regulations proceed to develop, the understanding and certifications needs become an increasing number of vital

Latest Posts

Tax Liens Near Me

Tax Lien Foreclosure Properties

Delinquent Tax Homes For Sale