All Categories

Featured

Table of Contents

They appear to have some of the best offer circulation of all the sites implying that there are a good number of opportunities to select from at any type of provided time. They also provide multiple kinds of bargains including their own fund. RealtyMogul is just one of the earliest gamers in the room.

They market themselves as the alternative to spending in supplies and bonds. They give access to private market genuine estate through their eREITs and eFunds.

Who offers the best Real Estate For Accredited Investors opportunities?

Some are readily available to. Learn more Actual estate crowdfunding has actually actually shocked the real estate financial investment landscape by drastically boosting the level of access to offers for the typical investor. It helped me dip my toes right into the property investing globe and has currently become a considerable section of my personal portfolio.

Undoubtedly, it's not without threat, and if/when there's ever a slump in the housing market, you will likely see some even more promoted losses. The much better the system, their monitoring, and their vetting procedure is, the much better off you'll be. No one system will certainly have a best batting percentage, there will be some deals that underperform.

It's also really vital for you to carry out the standard due diligence also. One method is by joining our program Passive Real Estate Academy when it's open. Or else, there are many great resources out there, you simply have to browse and gather a little bit. Please keep in mind that you have to be an recognized financier to purchase a great variety of these websites.

Anyone else have some favorites that I really did not discuss right here? How's your experience been with some of these sites?

In this overview, we have actually explored the following: What a recognized investor isTop investment chances for accredited investorsHow to come to be an approved investorIf you desire to discover even more regarding the investment opportunities open to this group of capitalists, read on. An accredited investor is a private, depend on, partnership, retirement framework, or other such organization entity enabled to trade and invest in protections that aren't signed up and provided with the Securities and Exchange Commission (SEC). The SEC generally requires "" Stocks not signed up with the SEC typically can not be offered to the general public.

They are allowed this exclusive gain access to once they satisfy at least one prerequisite associated to their revenue, possession dimension, total assets, professional experience, or governance standing. Being an approved capitalist has a number of advantages, including a broad choice of exciting financial investment options for profile diversity. You can invest in anything, whether supplies, bonds, commodities, or property, offered you have the risk resistance to manage it and the cash to make the required commitment.

How do I exit my Accredited Investor Real Estate Income Opportunities investment?

This elevates the concern, "What are the very best prospects for certified capitalists?" One considerable advantage of being an accredited capitalist is having a financial advantage over numerous others. Certified financiers have accessibility to financial investment openings and possibilities that those with less wide range do not. The worldwide choices market is expected to surge by $8 trillion over the next five years.

Below are eight opportunities worth taking into consideration: Investor are investors that provide resources or technological and managerial know-how for startups and local business with high growth capacity. They typically do this for a stake in the business. As these firms increase and raise in value, approved investors can make even bigger returns on their earlier investments normally symmetrical to their possession risks and the quantity invested.

Endeavor funding investing is often a terrific place to begin for capitalists seeking long-term growth possibilities. As with most alternative investment alternatives, you may have to compromise high dangers for potentially greater returns.

The performance spreads of financial backing funds are among the largest of any alternate possession course, with some supervisors generating much less than 0%. This is why manager option is the essential to effective VC investing. If you're considering VCs, you desire to select your investment automobile thoroughly and make them only a small part of your portfolio.

Recognized investors normally purchase these risky financial investment vehicles to exceed the marketplace or generate higher returns. Just the most affluent investors normally spend in hedge funds due to their high minimum financial investment or net well worth demands. While hedge funds have normally dominated private credit report markets, some approved investors now invest straight in his location.

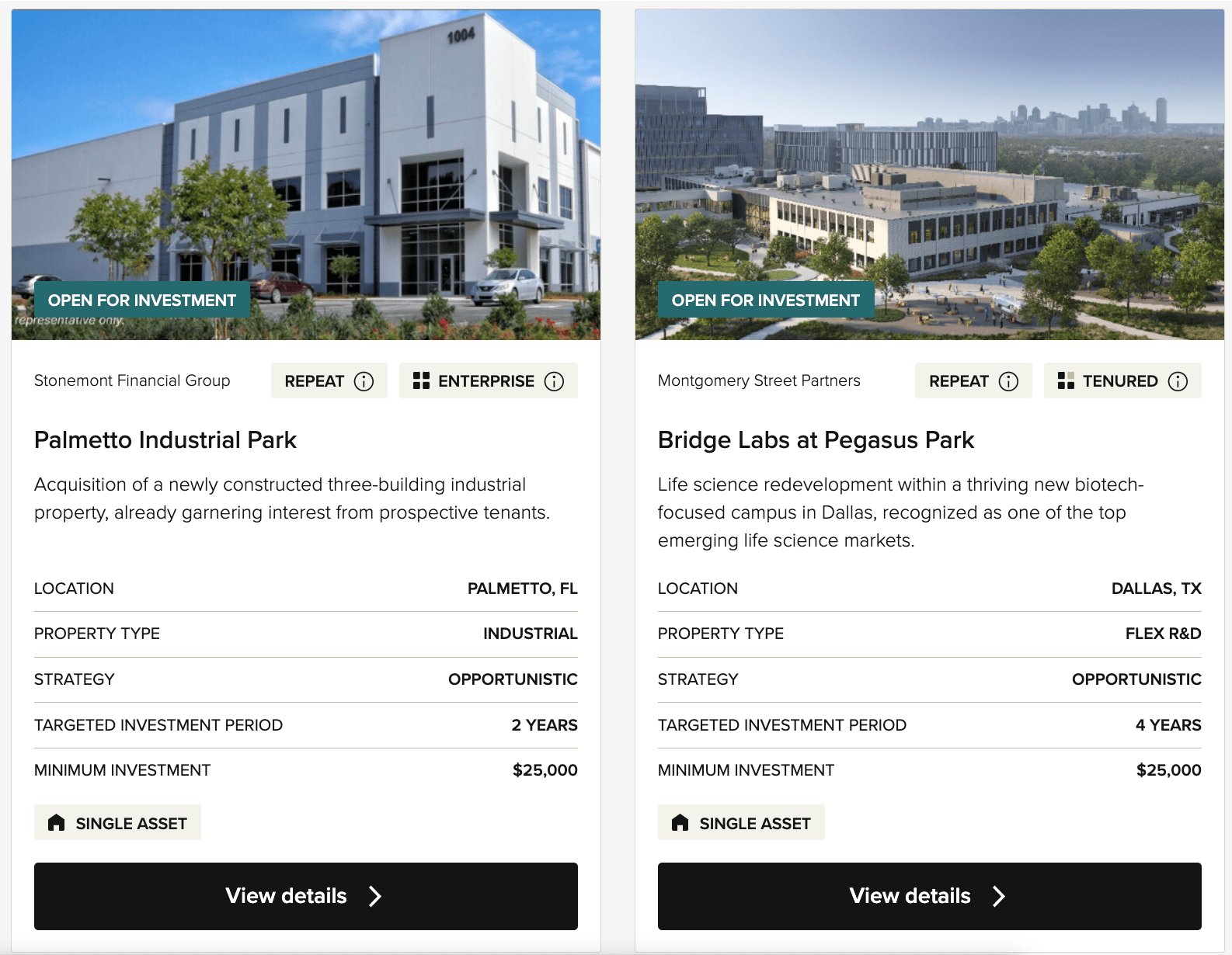

The area is large, and there are several opportunities to enter it (Accredited Investor Real Estate Crowdfunding). Actual estate syndication, especially multifamily, is one method accredited capitalists have joined property. A few other choices are spending via crowdsourced property systems or investing via private equity or bush funds concentrating on realty

What is the difference between Real Estate Investment Networks For Accredited Investors and other investments?

Is it worth coming to be qualified as a recognized investor? Again, it depends. It depends upon the sorts of investments you want, the current health and wellness of your total assets, your risk resistance, and several other factors that only you can answer. If you're not sure whether you should drop this road, let's take a minute to look at a few of the benefits and drawbacks ...

There are definitely benefits and disadvantages to both courses, and I would never suggest you to go versus your own goals, however, as usual, I do have a point of view here! Let's say you're a professional with some amount of funding that you would love to invest. You're an absolute beast in your field, but you do not have a lot of experience investing and have some problems regarding the finest location to place your money.

After substantial study, the very best actual estate crowdfunding systems for non-accredited capitalists are: Fundrise (all capitalists)RealtyMogul (certified and non-accredited) Real estate crowdfunding is the actual estate financial investment wave of the future. Specific investors can currently acquire items of industrial property jobs around the nation that were as soon as limited to establishments and ultra-high internet well worth people.

How do I exit my Private Real Estate Deals For Accredited Investors investment?

To come up with a $300,000 downpayment on a median valued $1.5 million home is daunting. Rather, capitalists need to think about realty crowdfunding as a means to gain direct exposure to actual estate. Genuine estate crowdfunding has actually become one of the most prominent investing mechanisms since the JOBS Act was come on 2012.

Unlike P2P financing, there's really collateral with property crowdfunding. This is why I'm a lot a lot more favorable on realty crowdfunding than P2P financing - Commercial Real Estate for Accredited Investors. The borrowers can't simply runaway with your cash and go away since there's a property. One of the problems with a number of the sites is that you require to be an accredited financier to take part.

Table of Contents

Latest Posts

Tax Liens Near Me

Tax Lien Foreclosure Properties

Delinquent Tax Homes For Sale

More

Latest Posts

Tax Liens Near Me

Tax Lien Foreclosure Properties

Delinquent Tax Homes For Sale